Table of Content

Your back-end DTI should not exceed 43 percent, though some borrowers qualify at 50 percent with compensating factors. Since 1995 we've been helping Australians learn about home ownership, compare home loans and get help from home loan specialists to find the right home loan for them. © 2022 NextAdvisor, LLC A Red Ventures Company All Rights Reserved. Use of this site constitutes acceptance of our Terms of Use, Privacy Policy and California Do Not Sell My Personal Information. NextAdvisor may receive compensation for some links to products and services on this website. At NextAdvisor we’re firm believers in transparency and editorial independence.

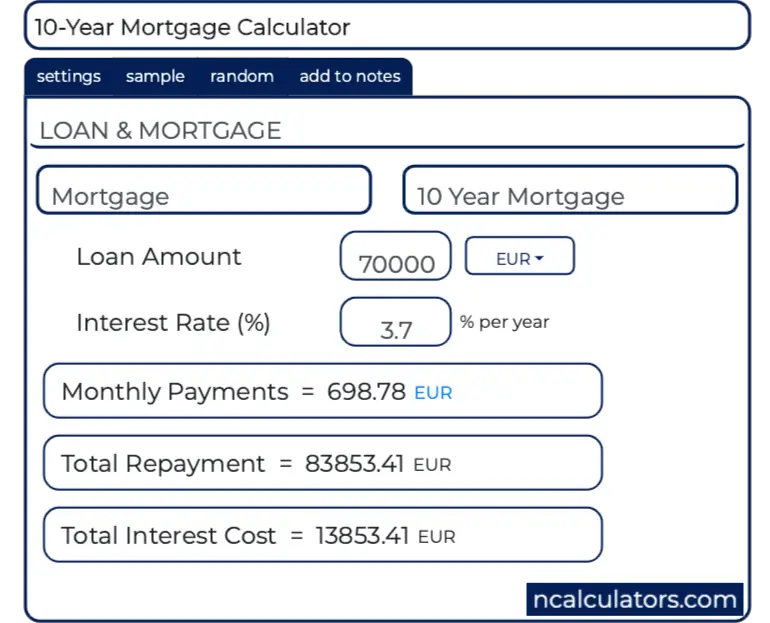

A 30-year mortgage comes with a locked interest rate for the entire life of the loan. Because the rate stays the same, expect your monthly payments to be fixed for 30 years. You can obtain 30-year fixed-rate loans from government-sponsored lenders, private mortgage companies, banks, and credit unions. This calculator will compute a mortgage's monthly payment amount based on the principal amount borrowed, the length of the loan and the annual interest rate.

Year Fixed Mortgage Interest Rates

Loan amount - If you're getting a mortgage to buy a new home, you can find this number by subtracting your down payment from the home's price. If you're refinancing, this number will be the outstanding balance on your mortgage. Most people use a mortgage calculator to estimate the payment on a new mortgage, but it can be used for other purposes, too. After a lender has vetted your employment, income, credit and finances, you'll have a better idea how much you can borrow. You'll also have a clearer idea of how much money you'll need to bring to the closing table. Next, you'll see “Length of loan.” Choose the term — usually 30 years, but maybe 20, 15 or 10 — and our calculator adjusts the repayment schedule.

The 30-year fixed-rate mortgage calculator estimates your monthly payment as well as the loan’s total cost over the term. Shorter loans come with lower rates sans the extra years of interest charges. Paying your mortgage faster also means you gain ownership of your home sooner. A mortgage is a loan secured by property, usually real estate property. Lenders define it as the money borrowed to pay for real estate. In essence, the lender helps the buyer pay the seller of a house, and the buyer agrees to repay the money borrowed over a period of time, usually 15 or 30 years in the U.S.

VA loan (government loan)

The principal is the overall amount of money being borrowed. You typically receive this money as a lump sum and then begin paying it back on a monthly basis. By default 30-yr fixed-rate loans are displayed in the table below.

Lengthen the term of your loan.Choose a longer time period to pay off your mortgage, like 30 years rather than 15. This will lower your monthly mortgage payments, although you will pay more in interest over the life of the loan. Personal loans are sums of money you can borrow from a bank, credit union or online lender that can be used for virtually any purpose. If you are in the market for a personal loan, compare top lenders to find the one with the best rate for your circumstances.

Loan Term

Refinancing a mortgage typically involves paying closing costs of 3% to 6% of the loan amount. For example, if you have a $300,000 mortgage, you can expect to pay between $9,000 and $18,000 in closing costs. Add your mortgage payment and other loan information into our mortgage refinance calculator to get a better understanding if refinancing makes sense for you. Monthly payments on a 15-year refinance loan will be bigger compared to a 30-year refinance at the same rate. However, a shorter loan term can help you build up equity in your home much more quickly. Your insurance policy can cover damage and financial losses from fire, storms, theft, a tree falling on your home and other hazards.

This makes it a popular financing option for buyers with tight finances. FHA loans come in 15 and 30-year fixed terms, as well as 20-year terms. Conventional loans charge a private mortgage insuranceif your downpayment is less than 20 percent of the home’s value. Out of all the mortgage options, you’ve probably noticed 30-year fixed rate loans. While many people get 30-year fixed mortgages, it’s worth knowing their benefits and drawbacks. It’s also important to know which lenders offer a deal that will suit your needs.

If you are having trouble qualifying for a federal loan, compare terms and rates on private student loans before choosing a lender, as these can vary widely. This is a good place to put an inheritance or a year-end bonus, for instance. Because half of the interest you pay in a standard 30-year mortgage accumulates in the first 10 years, the sooner into the loan you can do this, the better.

By 2001, the homeownership rate had reached a record level of 68.1%. Only four in ten Americans could afford a home under such conditions. During the Great Depression, one-fourth of homeowners lost their homes. Home affordability calculator to get an idea of how much you can afford. Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page.

Historically speaking, mortgage rates for 30-year fixed loans have been gradually declining. If we take a look at average rates from 2000 to 2020, it shows points were average rates have significantly decreased. The graph below is taken from the Federal Reserve Bank of St. Louis.

Loan term - This is the length of the mortgage you're considering. On the other hand, a homeowner who is refinancing may opt for a loan with a shorter repayment period, like 15 years. This is another common mortgage term that allows the borrower to save money by paying less total interest. However, monthly payments are higher on 15-year mortgages than 30-year ones, so it can be more of a stretch for the household budget, especially for first-time homebuyers. Conventional loans are backed by private lenders, like a bank, rather than the federal government and often have strict requirements around credit score and debt-to-income ratios.

Obtaining ARM is risky if rates consistently rise after the introductory period. Therefore, it is crucial for a consumer to be prepared for this possibility with ample funds. And when rates reset lower after the introductory period, they can take advantage of lower payments compared to a fixed-rate loan. Lenders may also ask for cash reserves to prove you have enough funds in the bank to sustain payments. Your lender may demand up to 18 months' worth of reserve expenses before they approve a jumbo loan. Apart from cash in the bank, lenders consider up to 70% of your retirement account.

Borrowers mainly adopt these strategies to save on interest. Property taxes—a tax that property owners pay to governing authorities. In the U.S., property tax is usually managed by municipal or county governments. The annual real estate tax in the U.S. varies by location; on average, Americans pay about 1.1% of their property's value as property tax each year. The United States Department of Agriculture backs USDA loans that benefit low-income borrowers purchasing in eligible, rural areas. While an upfront funding fee is required on these loans, your down payment can be as little as zero down without paying PMI.

No comments:

Post a Comment